The value of nature

Nature – a gigantic service provider

For time immemorial nature has been providing human beings with the resources they need for survival; things like fruits, grains, fish, meat or wood. It also puts a free supply of clean air and clean water at our disposal. Economists group all these aspects together under the heading of natural capital. In simplified terms, natural capital is defined as the stock of natural assets such as the soil, forest or ocean, which generate natural products and services such as fresh air or potable water.

- 1.10 > One of the first blast furnaces, in Coalbrookdale, England, in the year 1801. During the Industrial Revolution a paradigm shift took place in economics. Many experts lost sight of the significance of soil and the services of nature as economic factors. Only the investment of real capital was thought to determine economic growth.

- Measured against the several-centuries-old history of economics, the concept of natural capital is still very new. It was only coined in the second half of the 19th century. Until then, economists took nature and its services for granted. The sole exception was fertile agricultural soil. Before the invention of artificial fertilizers, the fertility of soils and hence their yield was limited. The productivity of farmland could not be increased at will because the quantity of nutrients was limited. Since adequate food had to be produced for the population nevertheless, large areas of land had to be farmed, and the number of people working in agriculture was very high.

After the German chemist Justus Liebig had invented artificial fertilizer in the mid-19th century, the situation changed. The productivity of farmland was increased several times over. Fewer farmers could harvest more crops. This released workers who were needed in the factories of the growing industrial towns. The importance of soil as an economic factor diminished. Instead, many economists came to consider real capital, in the form of machinery and infrastructure, as the only factor determining economic growth.

Never-ending harvest?

Very few thinkers gave more sophisticated consideration to nature and its services. Among them was the English philosopher and economist John Stuart Mill, who emphasized in the 1870s that nature ought also to be preserved for the sake of its intrinsic charm. Mill wanted to halt population growth. He feared that humankind would continue to destroy near-natural, aesthetic landscapes if the human population continued to expand.

1.11 > The English philosopher and economist John Stuart Mill noted in the 1870s that nature would suffer further destruction unless population growth was halted.

1.11 > The English philosopher and economist John Stuart Mill noted in the 1870s that nature would suffer further destruction unless population growth was halted.- At this time more concrete work was being done by the French economist Léon Walras, who published his Elements of Pure Economics, or the Theory of Social Wealth in 1874. Among other issues, he deals at length with the services of nature in his work, and develops the concept of natural capital. Walras, too, initially considers nature as an inexhaustible source because in his view natural capital cannot be destroyed entirely. On the contrary, he says, year after year it keeps supplying new products. Walras refers to this fertility of nature as a service, and to the yields that agriculture produces as “rents”. However, Walras recognizes that natural capital, like other forms of capital, can become scarce and that its value rises as a result: “the quantity of land can be very limited in an advanced society, relatively to the number of persons […] and has a high degree of scarcity and value”. Walras makes further distinctions and writes that natural capital can be used in two ways: firstly, as existing capital stock from which long-term income is generated – for example, an apple tree that provides fruit for many years – and secondly, as capital that is used directly – for example if someone cuts down the tree and sells the wood. Walras’s approach was extraordinarily modern in its analytical breakdown of the concept of natural capital. Even today, experts still make a similar distinction between stock and flow variables – in other words, between natural capital that is used and consumed directly, and natural capital that provides a continuous flow of rents over a longer period of time.

Despite Walras’s publications, natural capital played no part in economic theory for around another 100 years because economists were convinced that there could be no absolute scarcity of natural capital.

Is the value of nature measurable?

Today the concept of natural capital is well established. Even so, how the value of nature should actually be estimated is still a contentious issue. This question is important when it comes to quantifying the losses caused by progressive degradation of nature or assessing whether it is economically viable to invest in natural capital. Investment projects of this kind may include the restoration of degraded natural landscapes to a more natural state, or the near-natural management of forests. The valuation or monetization of natural capital is a huge challenge, particularly because natural capital does not take just one but many different forms – forests, rivers, meadows or the ocean. And all of them provide different services.

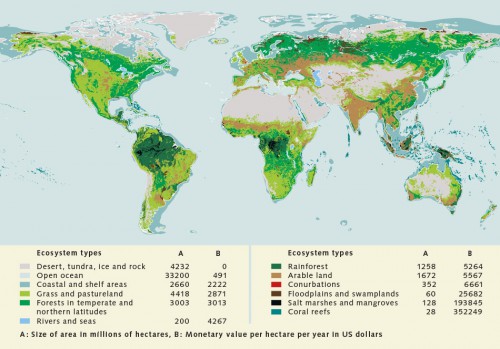

- 1.12 > World map with the different ecosystem types and the calculated values of their ecosystem services (in US dollars per hectare per year).

- Ecosystem service

Economists and sustainability theorists call any service that nature provides an “ecosystem service”. Examples are the availability of potable water, fresh air, or food in the form of fish and fruits. Added to these are aspects which are not directly measurable like the beauty of a landscape that provides people with recreation. “Natural capital”, in turn, denotes the natural resources which produce all these ecosystem services. - In 1997 a team of American scientists and economists published a study in which they attempted to document the total value of services provided by all ecosystems worldwide. They came to the conclusion that globalnatural capital including these various ecosystem services generates 33 thousand billion US dollars per year – almost twice as much as global gross national income which amounts to 18 thousand billion US dollars. In this study, the oceans accounted for the lion’s share, valued at 21 thousand billion US dollars.

For their study the scientists had divided the globe into around 20 ecosystem types and seventeen ecosystem services, such as climate regulation, water storage or food production. Subsequently, for every ecosystem and every service they determined the value of one hectare and then calculated projections for the total global area. In 2011 a new study was presented in which the data from 1997 was re-evaluated and the ecosystem services updated. One of the most important findings of this study was that because of land-use changes, the value of ecosystem services had fallen from 1997 to 2011 by at least an average of 4.34 thousand billion US dollars per year. Land-use changes are processes like the conversion of tropical rainforests and wetland areas into productive agricultural land.

- 1.13 > In order to assess the total value of services provided by all ecosystems worldwide, in 1997 US researchers defined various ecosystem service categories. Although the study was criticized because it massively simplified the worldwide situation, it was nevertheless a milestone because it made clear the vast overall economic significance of ecosystem services in their entirety.

* We include ecosystem “goods” along with ecosystem services.

- There was massive criticism of these studies. Experts complained that the projections were unreliable because they drastically oversimplified matters and did not adequately take account of the diversity of ecosystems. Another criticism was that having arrived at a figure, it was completely unclear which political consequences were to be drawn from it. Thus the studies provided no action guidelines on which natural capital ought to be protected or how. Although the first study appeared in the respected scientific journal Nature in 1997, today it is viewed less as a profound scientific paper and more as a politically motivated publication. As such, the experts say, it is significant because it showed for the first time what order of magnitude the value of natural capital can actually reach.

Different types of services

The publication of the study in 1997 prompted the question of whether it was even permissible to give natural capital a monetary value. One of the arguments voiced was that natural capital is vital to human survival, irreplaceable, and hence of infinite value; monetization was inappropriate. Very few experts still defend this extreme position today. Nowadays only “primary values” which represent the basis for life on Earth – such as solar radiation, fresh water or atmospheric oxygen – are considered to be non-monetizable. Putting a price on such primary values would make little sense.

- 1.14 > Part of the flower of the orchid species Lepanthes glicensteinii is shaped like the genitalia of a female fungus gnat. Deceived into copulating with the flower, the male picks up pollen, with which it subsequently pollinates other plants – an example of a regulating ecosystem service.

- What is certain is that a monetary value can only be applied to natural capital if it is considered on a smaller scale. Thus it is virtually impossible to determine the value of the sea in its totality, but very much easier for a particular marine region or a specific service. Before one can even attempt to value natural capital, it must first be categorized. The United Nations (UN) launched an attempt to do so in 2001 with the major international project, the Millennium Ecosystem Assessment (MA), in which several hundred researchers analysed all ecosystems worldwide and allocated them to different categories of servicesdifferent categories of services:Further information on this topic is available here:

- Supporting services, which maintain the ecosystem itself, such as nutrient cycles or genetic diversity;

- Provisioning services, which produce food, water, building material (wood), fibres or pharmaceutical raw materials;

- Regulating services, which regulate the climate, ensure the absorption of wastes and air pollutants, or are responsible for good water quality or for plant pollination;

- Cultural services, which facilitate recreation, nature tourism, aesthetic pleasure and spiritual fulfilment.

- Although such a breakdown can be helpful for the monetization of natural capital, many ecosystems and the multitude of interrelationships among living organisms are so complex that their significance and performance, and hence their value, cannot be captured in their entirety. It is hard for scientists even to assess what consequences might result from the disappearance of a single animal species, such as a predatory fish species, let alone the destruction of an entire ecosystem. Orchids in the rainforest, for example, are found to be pollinated by one sole insect species in some cases. If the insect is lost, the orchid dies out, and this in turn affects other animal species which are dependent on it. If this relationship goes unrecognized, the value of the insect species will be underestimated.

The valuation of ecosystems is also complicated by the diverse ways in which they are interwoven and reciprocally influence each other. Researchers are often virtually unable to discern these dependencies – and hence also the services that ecosystems provide for one another. A mountain forest, for instance, stabilizes the soil. If the mountain forest dies, erosion escalates. Soil is washed into streams and rivers, which also affects the living conditions for marine organisms in coastal waters.

The value of nature – today and tomorrow

Thus, in order to be able to assess the value of natural capital in a manner that captures the linkages and dependencies, even finer differentiations must be made. Economists attempt to do so by assigning the ecosystem services of nature to different value categories. The total value of any given natural capital is then obtained from the sum of all its services – experts talk about the Total Economic Value (TEV) of an ecosystem. Under the TEV approach, an initial distinction is made between the use value resulting from the use of the natural capital, and the non-use value which the natural capital represents in itself. The use value and non-use value are then broken down still further.

- The use value includes:

- the direct use value, provided for example by a fish that has been caught. This value can be expressed in concrete terms for any given service in the form of a market price;

- the indirect use value, such as the climate-regulating effect of a forest, or the sea, or natural water purification in the soil;

- the option value which arises through any potential future use of the given natural capital; for example, pharmaceutical ingredients which are obtained from marine organisms.

- the existence value that human beings attach to creatures like blue whales or to habitats like mangrove forests, without necessarily thinking that they will be able to use or even experience these habitats themselves in future. The existence value arises from the sheer delight of knowing that these creatures or habitats exist;

- the bequest value, which exists because people feel the desire to pass on natural resources as intactly as possible to subsequent generations.

- The MA and TEV are related approaches. Thanks to the two, the significance of ecosystems can better be assessed today, although both only classify rather than supplying any concrete monetary values. While the objective of the MA was to gain an overview of global ecosystems and ecosystem services, TEV makes much finer distinctions in respect of these services. TEV results in a better assessment not because it combines all values into a composite value, but rather because it takes account of different value categories in the first place. This makes it possible to compare the significance of different ecosystem services with one another. Today it is known that many ecosystems, and hence also forms of natural capital, are in poor condition. As an approach to improving the situation, however, it makes little sense to establish some total value of natural capital in monetary terms. The pertinent question is rather, which measures might be used to prevent the destruction of an ecosystem, or how its condition might be improved. Normally a host of concrete measures are available for this purpose, which must be weighed against each other. As part of this, prior categorization of the ecosystem services using TEV is helpful.

- For example, for several years now the British Department for Environment, Food and Rural Affairs (Defra) has been using TEV for the valuation of nature conservation measures such as the restoration of bird sanctuaries. Furthermore it makes use of TEV in order to study what difference parks and green spaces make to the general health of the population by providing space for recreation, sport and outdoor exercise. Clearly the management or conservation of parks and green spaces costs money. Moreover, it means that this land is unavailable to be built upon. But the Defra studies conclude that the gain for the population is substantial because outdoor exercise prevents illnesses. They find that a single park in an urban area saves the health system annual costs amounting to 910 000 pound sterling (around 1 150 000 euros) on condition that 20 per cent of the town’s citizens make use of the green spaces. Thinking this through, it becomes clear that the total value of natural capital at the present moment is not as relevant to its valuation as the value resulting from changes. The smaller the available park area, for example, the greater its rela-tive value becomes because fewer and fewer square metres are available for the benefit of those seeking recreation. What is important in this context is the size of the park area to begin with. Thus, the loss of value is much greater if a few square metres are deducted from a small area of parkland than from a huge park. Equally, a few extra square metres creates much less additional value for a large park than for a small one. Changes in the value of natural capital of this kind, resulting from measures such as the destruction or creation of a park landscape, play a major part in the sustainability debate. Economists refer to this issue in terms of “marginal changes” or “marginal values”.

- 1.15 > The Hong Kong Park, opened in 1991, has direct benefits for citizens in the form of recreation, but also a high indirect use value because it improves the inner-city microclimate.

- In many cases a monetary value can be assigned to a certain category of an ecosystem service. A park that serves residents as a leisure facility, for example, has a very particular monetary value in the form of cost savings in the health system – i.e. a direct use value. It is considerably more difficult to determine the indirect use value of this park; its contribution to a better inner-city microclimate, for instance.

As a means of establishing the indirect use value of natural capital, an estimate can be made based on consumer surveys of how much a household would be willing to pay to improve environmental conditions – in this case, for example, for the enlargement of an inner-city park. Economists refer to this as “willingness to pay” (WTP). Another figure to be determined is the extent to which the population would accept compensation for any deterioration in environmental conditions (for example, if the park were reduced in size or built upon) – how great the “willingness to accept” (WTA) is.

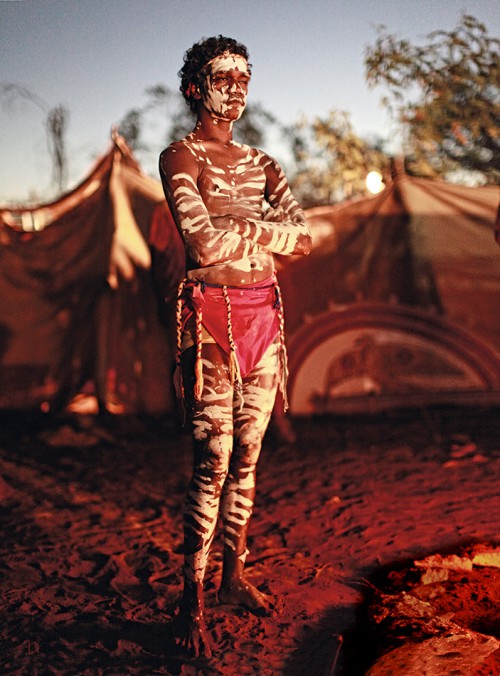

WTP and WTA are often dependent on a cultural or societal context and are therefore impossible to determine in some cases. If a population attaches a cultural or even religious significance to a park, a landscape or a natural monument, it will be very reluctant to accept any changes to it, let alone its destruction. Many sustainability experts call for such factors to be taken into account in the valuation of natural capital, even if they are barely quantifiable.

- 1.16 > The indigenous inhabitants of Australia, the Aborigines, believe that their continent is crisscrossed with invisible, mythical dreaming tracks – a special kind of cultural natural capital that was often fragmented or destroyed by construction schemes.

Dearth of knowledge

How difficult it is to assess the value of natural capital is also demonstrated by a recent study conducted by German economists. The researchers analysed a range of publications on the theme of ocean acidificationocean acidification. They wanted to find out whether robust findings existed on the future costs of ocean acidification, and who might be affected by it.Further information on this topic is available here:

Ocean acidification is, alongside global warming, one of the most feared consequences of climate change. The oceans absorb from the atmosphere a large proportion of the greenhouse gas carbon dioxide that is emitted by the burning of natural gas, petroleum and coal. Expressed in simple terms, this results in a build-up of carbonic acid in the water, and the pH value of the water gradually drops. Marine scientists fear that this could affect corals and fish larvae as well as bivalves and snails which produce calcareous shells.

- pH value

Chemists determine the acidity of a liquid with reference to the pH value. The lower the value, the more acidic the liquid. pH values range from 0 (very acidic) to 14 (very alkaline). Since the Industrial Revolution the pH value of the oceans has fallen from an average of 8.2 to 8.1. By the year 2100 the pH value could decrease by a further 0.3 to 0.4 units. That sounds negligibly small. But the scale of pH values is logarithmic. It is mathematically compressed, so to speak. In reality the ocean would then be 100 to 150 per cent more acidic than in the middle of the nineteenth century. - The study found that publications on the economic impacts of ocean acidification largely deal with the direct economic impacts on human beings, and particularly with the consequences for the fishing industry. Just a few papers analyse the situation with regard to coral reefs. While these mention that coral death could cause losses in tourism revenue, they stop short of any precise economic analysis. Moreover, not one publication mentions the indirect consequences of coral death; for instance, it would also have a detrimental effect on coastal protection. The authors of the study list a number of gaps in existing research content:

- A majority of the economic studies focus on direct economic impacts such as a decline in the catch of fish or shellfish in certain marine regions. Existence or bequest values are left out of the analysis.

- No knowledge is available as yet on how the pH value in coastal waters might change in the future. Hence it remains unclear which marine regions are likely to be most heavily affected. But precisely that knowledge is important in order to ascertain the magnitude of the economic consequences in situ – and to intervene with well-targeted counter-measures.

- Another fundamental problem is that the findings on ocean acidification in scientific publications are often presented in a form that is not usable for an economic analysis. Often, simplifying assumptions are necessary in order to be able to project changes in the gross revenues of fishers from data on changes in a calcification rate in bivalves.

Accordingly, the authors come to the conclusion that it is simply not possible to assess the economic impacts of ocean acidification today because even just the marine biochemical processes are too complex. Furthermore, many published studies refer to organisms which are easy to observe or to keep in a laboratory but which have absolutely no claim to any particular economic relevance or vital importance to ocean food webs. Since the scientific journals are the basis for the economic studies, their credibility in turn must be considered very limited.

The authors of the study therefore propose closer cooperation between natural scientists and economists for the future, addressing not just ocean acidification but all other environmental threats and ecosystem services as well. In collaboration it would be possible to tackle natural sciences research topics which are also of economic significance. Perhaps in that context organisms might be selected for studies specifically because they are interesting from a market economic viewpoint.

1.17 > In September 2009 fishers and other seafarers along the Pacific coast off Alaska protested against ocean acidification.

1.17 > In September 2009 fishers and other seafarers along the Pacific coast off Alaska protested against ocean acidification.Prioritized for protection: critical natural capital

The forms of natural capital of particular interest today are those which are so significant that everything possible should be done to prevent their destruction. Sustainability theorists refer to these as critical natural capital stocks.

A majority of experts include in this category forms of natural capital which are not substitutable by anything else – for example, scarce groundwater resources in the arid zones of Africa. This critical natural capital must be preserved because it is of elementary importance for human beings.

Other experts say critical natural capital also includes natural areas which merit protection not because they are existentially important to people but because they are habitats for threatened plant and animal species. This somewhat broader view of critical natural capital is supported by nature conservationists in particular – among them, the British environment agency “Natural England” (“English Nature” until 2006). Back in the 1990s this agency defined several categories which can help to identify land-based critical natural capital:- Small-scale habitats with rare or threatened organisms;

- Ecosystems that represent a characteristic habitat with all the typical plant and animal species;

- Areas that provide important services such as protection against erosion, absorption of environmental pollutants or provision of drinking water;

- Areas of geological significance, particularly geological formations like the Grand Canyon in the USA, which are of special scientific interest or uniquecharacter.

Uniting to conserve natural capital

The good news is that over the years a number of large-scale initiatives have been successful in protecting different forms of critical natural capital. Noteworthy successes have been the establishment of national parks and the adoption of various international conventions or special directives on nature conservation. In these cases the urgency of the need for action was plain to see, making it unnecessary to determine the value of the natural capital in detail beforehand.

One example of these forward-thinking conservation efforts was the International Montréal Protocol of 1989, which prohibited the use of chemical substances that deplete the ozone layer. To this end, very concrete limit values for the production of chemicals were specified. The signatory countries made a commitment to reduce and ultimately completely phase out the emission of particular substances. In this way it was possible to conserve the ozone layer as a primary value and as natural capital of life-and-death importance.

A further example is the Washington Convention (Convention on International Trade in Endangered Species of Wild Fauna and Flora, CITES) which has strictly regulated trade in rare or endangered species since 1973.

Common goals for a sustainable future

In the year 2000 a working group convened by the United Nations formulated eight Millennium Development Goals (MDGs) which were to be accomplished by the year 2015. These were intended to bring about clear improvements in the living situation of people in developing countries and emerging economies and, at the same time, to conserve various forms of natural capital. The MDGs undeniably focus on the reduction of poverty and poverty-related hardships, and on aspects like health and education.

Today it is evident that these goals have not yet been achieved worldwide. A further United Nations working group has therefore now defined Sustainable Development Goals (SDGs)Sustainable Development Goals (SDGs)for the period from 2015 to 2030 that frame objectives in more concrete terms than the MDGs did. The SDGs are no longer restricted to the developing countries but address the whole world. Moreover, by taking the domains of sustainable agriculture, energy and climate change and the oceans into account, they are designed to have a stronger focus on the conservation of natural capital. The following aspects are considered essential to the SDGs:Further information on this topic is available here:- Food security and sustainable agriculture,

- Water supply and improved hygiene,

- Energy,

- Education,

- Poverty reduction,

- Resources to conduct the SDG process,

- Health,

- Climate change,

- Environment and natural resource management,

- Employment.

- These aspects are sorted by priority. Taken together, they illustrate clearly that the United Nations working group has endeavoured to give balanced consideration to all the aspects that make up the classic three-pillar model of sustainability. Developments over the coming years will show whether states actually succeed in striking this balance.